Background

Netback is a concept used to determine the profitability of production locations in a crude or natural gas producer’s network. The netback prices calculated during this process are also used to determine what should be paid to the royalty interest owners of a particular well. The methodology involves starting with the sale of a product and netting back the sales value and quantity from the sale location to the production location. This is achieved following the reverse path that the product took to get to market.

Deals

The equation used in this calculation is not issued by any regulatory or accounting standards board, which allows netback concepts to differ from organization to organization. Companies calculate their netback differently based on a variety of factors. A simplified calculation that is offered by CTRM systems to calculate netback is the following:

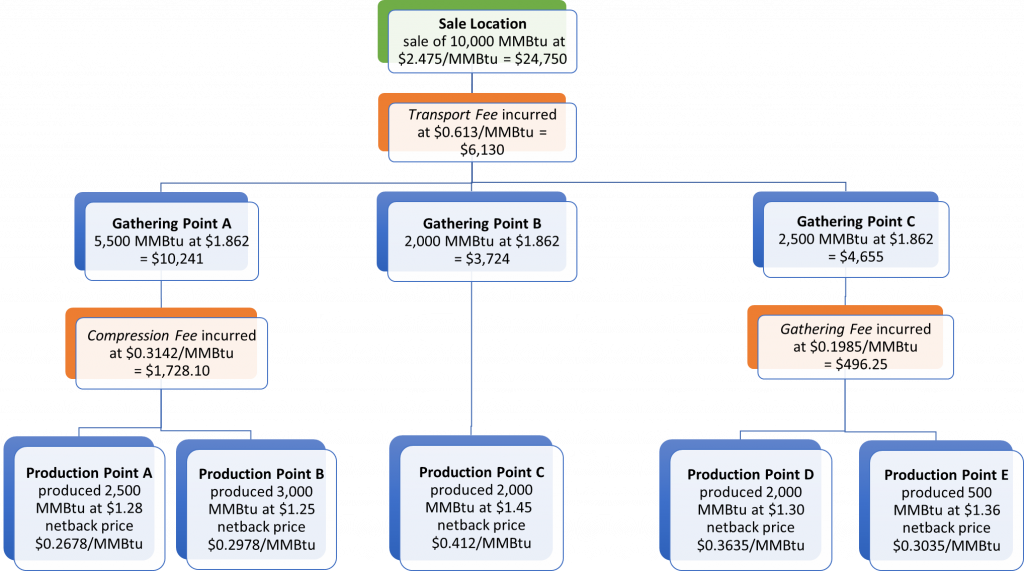

A rudimentary example of a netback calculation using the equation above looks like this:

In this diagram, 10,000 MMBtu of natural gas sold to a customer is netted back through the path it took to arrive at the sale location, which will identify fees and associated production costs. At each point in the pipeline (or location in a producer’s network), the WASP (weighted average sales price) is recalculated by subtracting fees from the original sales value of the gas and dividing this value by the quantity at each location. In reality, more than 10,000 MMBtu of gas would have to be produced in order to transport and ultimately sell 10,000 MMBtu at the final sales location. Losses and values associated with these losses are not reflected in the example scenario but represent a particularly important variable of the netback equation.

Additional Considerations

In addition to losses, the example above does not take into consideration a series of choices that firms examine in a netback calculation:

- What price is used to value inventory?

- Which fees are deducted or not deducted from the WASP?

- How are fees factored into netback at interconnect locations?

- What price is used for valuing product losses or gains?

- How are ‘linefill’ quantities handled?

- How to account for and/or value imbalances?

- How and when to generate prior period adjustments?

These questions yield an endless number of configuration combinations that could vary depending on the producer, carrier, product, or location. If modeling these deals in your application seems confusing, this is normal!

CTRM solutions provide limited flexibility for netback calculations and do not allow for companies to manipulate all or many of these decision points out of the box. This leaves many customers with netback calculations that are incomplete in the system and require modification outside of the software in spreadsheets or other applications, leaving companies exposed to the risk of human error such as incorrect data entry or calculations. Erroneous netback prices can lead firms to over or under pay their royalty interest owners, creating extra work to correct these issues.

We Can Help

Our team has more than a decade of experience working with CTRM systems and netback calculations. If you are interested in completely integrating netback inside of an existing CTRM system by eliminating out of system workarounds, please reach out!