This document walks through the correct booking of a constant maturity swap (CMS), and how to reconcile the projected resets to the breakeven rate on the underlying forward-starting swap.

Findur has out-of-the-box support for CMS caps, floors and CMS spread caps and floors.

Constant Maturity Swap

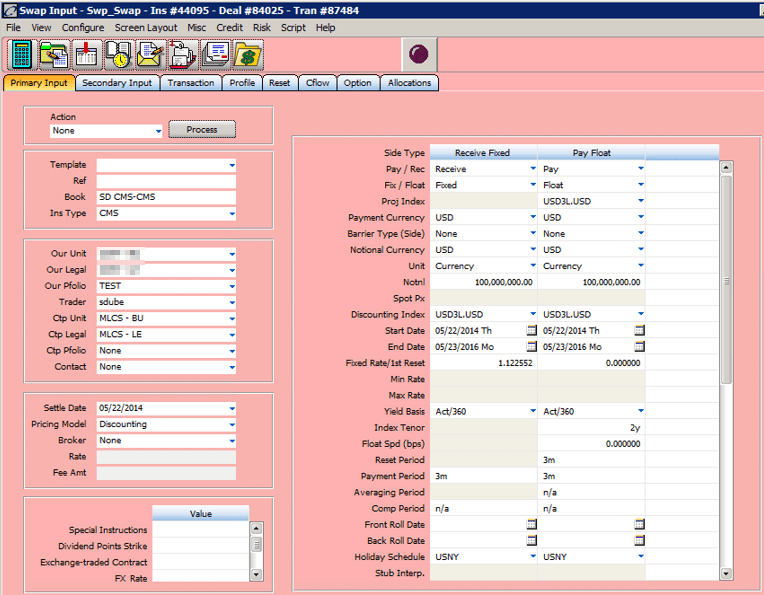

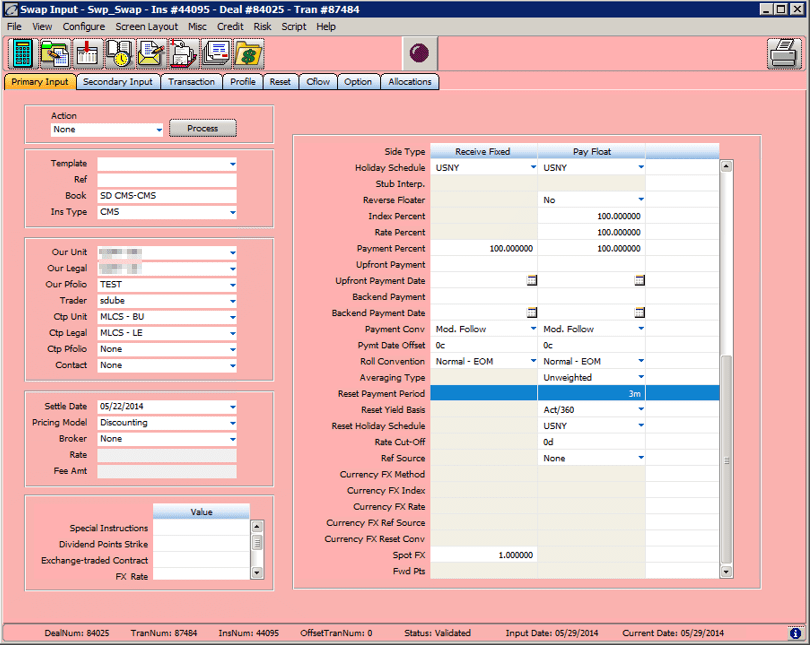

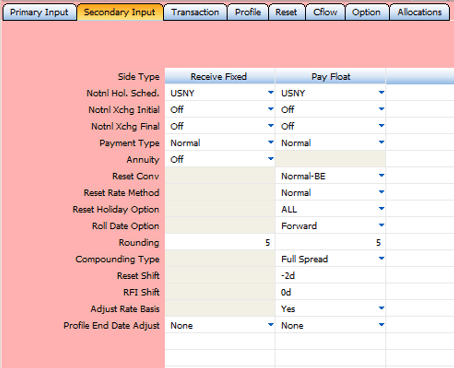

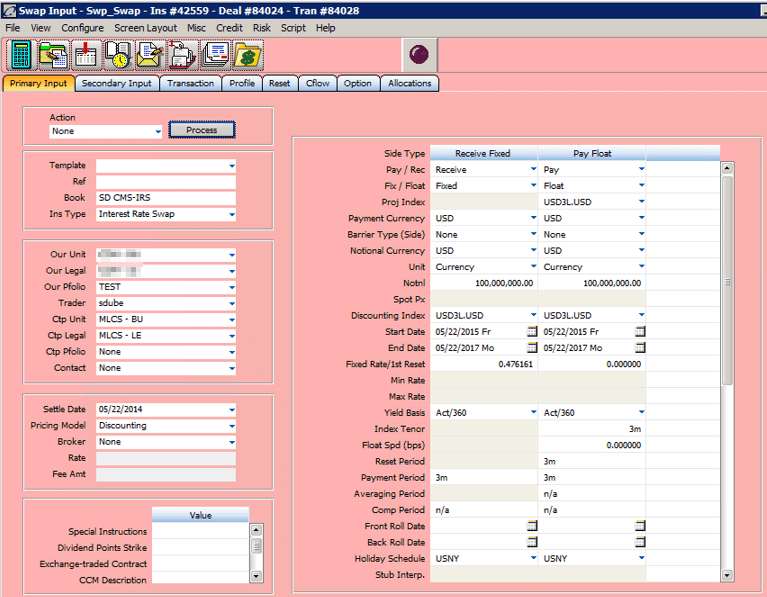

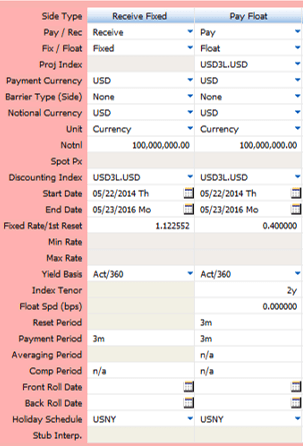

In this step, we will book a new 2y CMS resetting/paying quarterly off 3m LIBOR. Note that the native instrument type in Findur is called YCS, short for Yield Curve Swap. In these screenshots we show a user-defined instrument type that uses the more common acronym CMS.

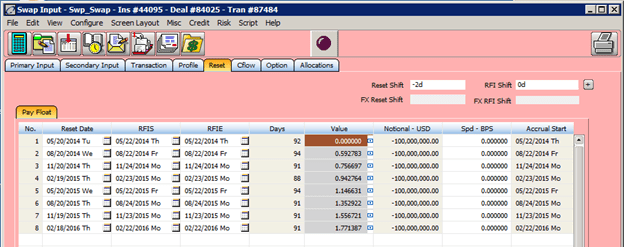

We want to verify the projected resets on the CMS are consistent with a forward-starting 2y swap’s breakeven rate.

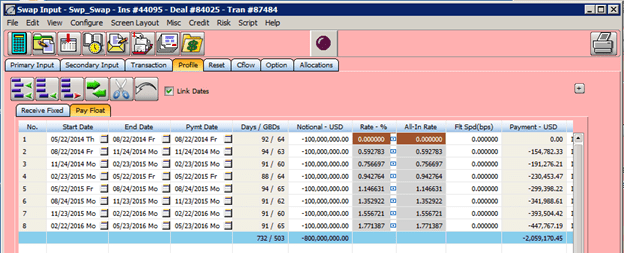

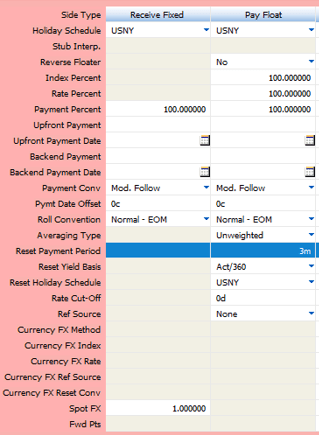

It is important that the Index Tenor is set to the CMS tenor: 2y in this example. The Reset Payment Period should be set to the payment frequency on the underlying swap: quarterly in this example. The Reset Period and Payment Period match the terms of the CMS.

The projected forward rate of the reset effective 5/22/15 should be the projected breakeven rate on a 2y swap that starts on that date. The projected breakeven swap rate is 1.146631%.

Forward-Starting Swap

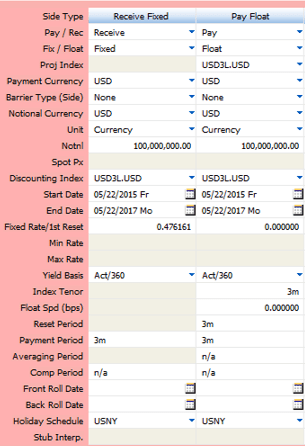

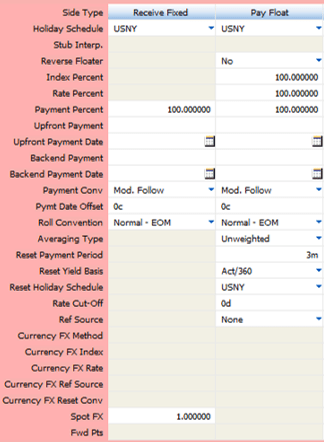

Book a vanilla IRS resetting/paying quarterly off 3m LIBOR. The objective in this section is to calculate the breakeven rate on the forward-starting swap. It should match the projected reset on the CMS.

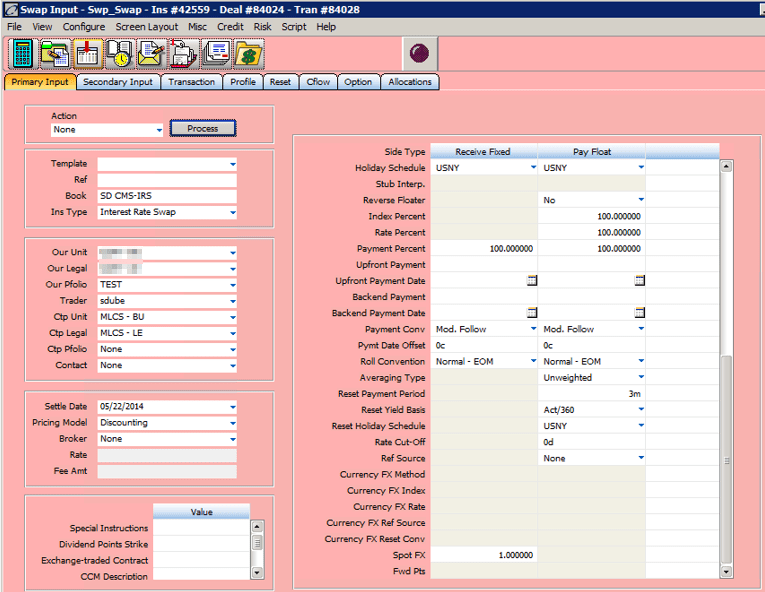

Primary terms of the Forward-Starting Swap: Primary Input Tab, 1 of 2

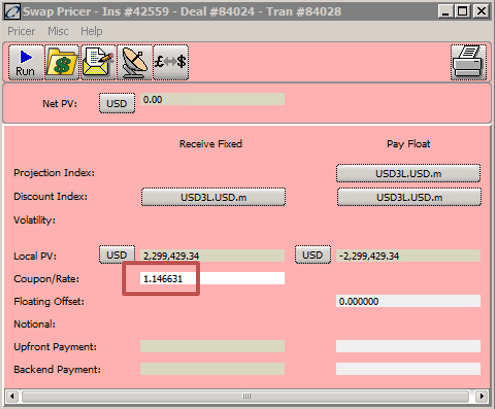

Hit the Pricer button on the swap. Enter a Net PV at the top of the screen of 0. Double right-click (yes, double right-click!) on the coupon/rate field.

The fixed rate that makes the PV of this forward starting swap zero is 1.146631%. This is the same value as the projected reset on the CMS for the floating rate of 5/22/15.

The user can also run a full simulation and select the ‘Breakeven Rate’ result to arrive at 1.146631%.

CMS Options and CMS Spread Options

CMS cap and floor options are booked following the same field-setting procedures as for the CMS. The appropriate instrument types to use are called YCC (short for Yield Curve Cap) and YCF (Yield Curve Floor).

Findur supports CMS spread options. Use the YS-CAP and YS-FLR instrument types. These are multi-leg instruments to capture the strike on the first leg, the first CMS rate on the second leg, and the second CMS rate on the third leg.

Side-by-Side Primary Terms

Here is a view of the primary page side-by-side to check the deal terms and conditions line up between a CMS and the underlying swap. The easiest mistake to make is to set a field incorrectly.

| Constant Maturity Swap | Forward-Starting Swap |

|  |

|  |